- Are you not sure how much insurance do you need?

- Wondering if the insurance policies (sum assured) that you hold is sufficient?

- How long your dependents can survive from insurance claim amount received will be sufficient for your family, if you die today?

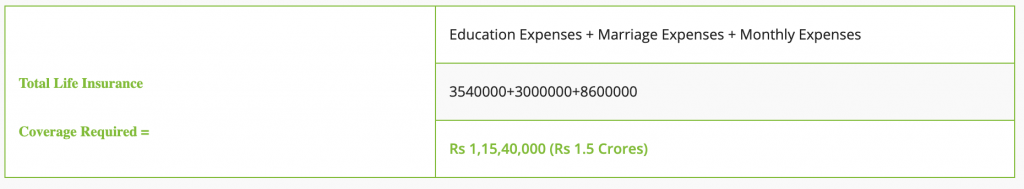

The amount of Life Insurance coverage a person should have will depend upon Spouse life expectancy, Kids education and marriage expenses, Inflation

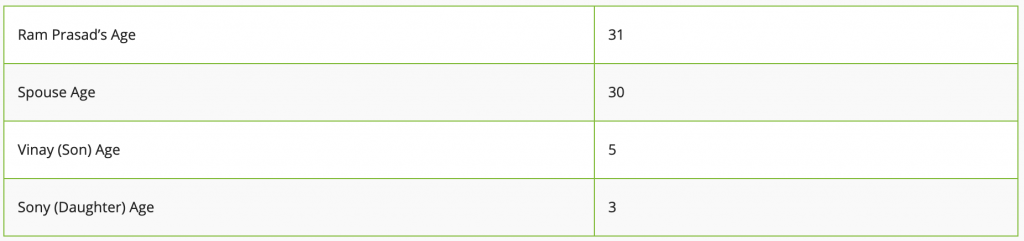

Let’s understand through the following case study:

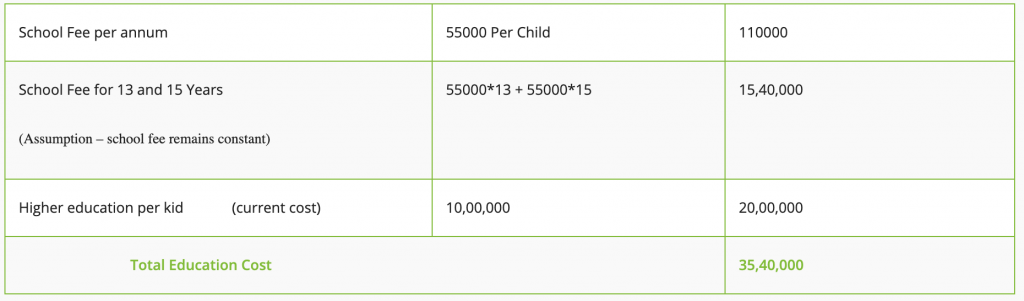

1. Following are Kids education expenses

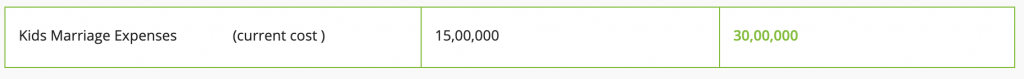

2. Marriage Costs are as flows:

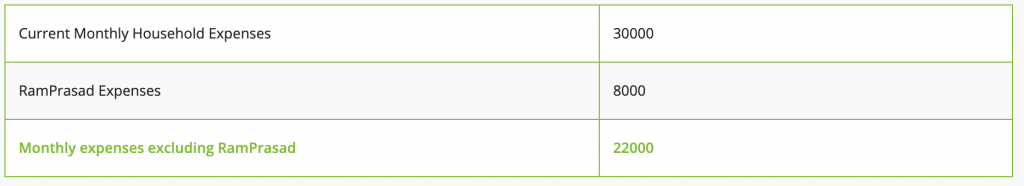

3. Household expenses cash flow till Spouse age of 80 years

To provide Rs 22,000 monthly withdrawal to family for 50 years (80-30 = 50), corpus required today @ 6% inflation and 8% Risk Free Returns = Rs 86,00,000 .