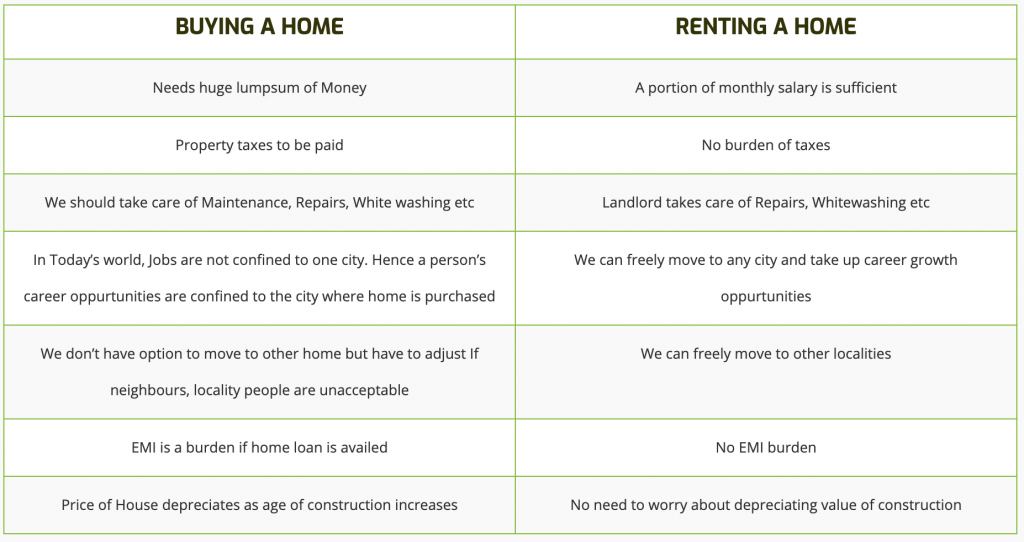

In today’s post let us look at parameters in Buying a Home Vs Renting a Home

Most of the home purchase transactions happen on availing the loan, which is detrimental to an individual’s financial health. People get into long-term commitment to pay the home loan EMIs by availing loans up to 80 to 85% of the purchase price.

With small savings wiping out and have to shell out EMIs every month, slowly they start regretting the decision of buying the house.

Some people pour all of the buffer amounts after expenses and EMI to clear up the loan principle availed. This happens at a cost of future needs (like Child Education / Marriage / Retirement) but an individual doesn’t realize it as he/she cannot foresee the future financial needs at that point in time.

Please feel free to comment if you think I have missed any points.